[Update: This editorial wasn’t really written by the guy I originally said it was written by. I’m not sure who actually wrote it, but they gave rights to freely distribute it, so we’re OK.]

We’re going to call this Monstropolitan’s very first guest editorial, although the guest who wrote the editorial isn’t yet aware of it!

My friend/former roommate, McKay Bonham, sent me something that his uncle got from some guy, which explains what happens when you build a house of cards on a sandy foundation. I’m reproducing this below (plus bonus features by yours truly!) If you’re hoping to feel all warm and fluffy inside, don’t read this. But if you want to have a better idea of what’s going on out there in the wild world of financial disasters, I highly recommend it. (Also available in THX.)

I, personally, am not ready to declare The Beginning of The End or anything like that. I don’t know what’s going to happen. Maybe this whole thing will just wash over. Or maybe it will become a true economic catastrophe, the defining experience of our generation. Anything could happen. But I am convinced, as the author outlines towards the end, that we have been amply warned that this storm was coming. Have you done what you can to batten the hatches?

Here it is. It makes for grim yet enlightening reading, so, to use the old saying, “have fun!” 😐 [Note: I took minor editorial liberties with the text and formatting, but nothing substantial has been changed. The endnotes are mine.]

Our Economic Position

by Some Dude

I’m deeply concerned about the events surrounding our country. I believe the so-called “economic crisis” really is a crisis, and it’s unlike anything experienced by our country in the past. In short, I believe it’s worth paying very careful attention to the events unfolding around us. I hope what follows is of some value to you.

A Little Background on How We Got Into This Mess

The issue at hand is how banks use debt to make a lot of money. What follows is an excerpt from Brian Shellabarger’s book on how derivatives work:

The world economy has been growing a rate that far exceeds the population and income growth rates. The reason is simple: We’ve figured out new ways to leverage debt so we can buy more. From a personal standpoint, I think we all understand that the more you put on the credit card, the more “stuff” you can buy. The more stuff you buy, the better the overall economy does. Buying more stuff means more stuff has to be made, which means more jobs—it also means more debt for you! Simple, right?

On a much larger scale, banks play the same game with what are known as “derivatives”. Derivatives are the ability to borrow money based on the assets you have as collateral. While the term is usually only in reference to banks, average citizens can play in the derivative game, too. Most of us don’t have a stomach for that kind of risk, but just to help you understand what they are and how they work, here’s a real example of how a person (like you and I) could get themselves in trouble with derivatives.

Let’s say you open a stock-market trading account with Morgan Stanley. You send them $50,000 and they deposit that money into your account. You use that money to buy $50,000 in stocks (Microsoft, GM, McDonalds… all your favorites). You now have assets worth $50k. The bank (Morgan Stanley) will lend you up to 50% of the value of those assets (if you don’t pay them back, they’ll sell your stock to cover it. If the value of your stock goes down, there’s enough “room” in there—50%—that they can always sell off your assets if things start going badly in the stock market). This is called a “margin loan”… You decide to do this, so Morgan Stanley writes you a check for $25,000.

You decide to take your $25,000 and open another investment account at Ameritrade. You deposit your money, buy more stocks, and, once again, take out another margin loan. They send you a check for $12,500. You take this check to E-Trade and open another brokerage account, buy more stock, and take out ANOTHER margin loan for $6,250….

You see where we’re going. The term for this is “leveraging up”. Your $50,000 allowed you to own nearly $100,000 REAL assets. If you think this feels like a pyramid scheme, you’re right. The dark side is that if the “bottom falls out” and your $50,000 suddenly becomes worth $10,000 (maybe McDonald’s goes out of business?) the entire house of cards will collapse on top of you. Every loan will declare the entire balance “due” because you no longer have the underlying asset to back it all up. We have, in effect, tricked the banks into lending us money by making them think they have the right to an asset if we default, when in reality, we’ve already promised that asset to someone else. It’s “risky business”, but it works well in a booming economy.

Remember, this is not the stuff of financial gurus. This is something you could do today with horrible credit. There are no checks and balances tracking where the money goes or why—you control all of that, and you don’t need good credit because there’s always the illusion of an asset backing your next “level” of investment. In reality, there’s only one asset (the one on the bottom), but the other banks don’t know that. All they see is cold, hard cash.

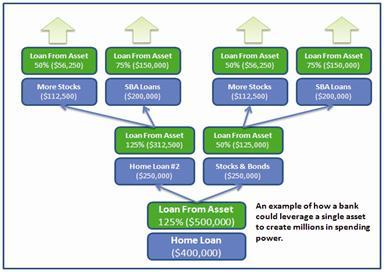

Banks, on the other hand, have very good credit. They get much better lending terms than you are I. While you and I can leverage (on average) 50% of the value of our assets, banks can often leverage 125% (or more) of their underlying asset.

Mortgages usually sit “at the bottom” of this house of cards that banks like to build. They’re the foundation of the debt-scheme because they’re safe, secure, and they represent real property and real returns. They’re solid. In fact, mortgages are so well respected in the financial industry, a bank could easily leverage more than $3 million in “derivative investments” with a $400,000 mortgage sitting at the bottom. Sometimes they’ll even buy a mortgage with the money derived from another mortgage (making it even harder to find the underlying asset the whole thing is based on).

Occasionally, mortgages (or other investments) do go bad. Banks have enough money they can shift things around until it all balanced out again. They’re pretty good at playing the game (they’ve been doing it for a long time)—the banks simply hope (and bet) that an unusual number of home loans won’t default at the same time.

… But what if they do default all at once?

What’s Actually Happening with the Sub-prime Mortgages?

Starting in the mid-1990’s, Congress passed legislation forcing banks to issue these sub-prime loans. (I could probably write a book on that alone, but for now it’s enough to know that the government stepped in and decided to regulate the mortgage industry to help people afford houses.) So for the last 20 years, they’ve been issuing loans that people couldn’t really afford. This all came to a head over the last 5 to 7 years when banks really perfected the concepts mentioned above (building derivatives on top of home loans) and decided to really expand their sub-prime programs due to super-low interest rates.

The problem the banks ran into about a year ago is that the interest rates that were allowing people to buy all these high-risk mortgages (the ones that sit on the bottom of their debt pyramid) started going up, and when the adjustable rates adjusted, people could no longer afford their homes. (It’s like the credit card company who offers you 6-months free interest—once the interest kicks in, you may not be able to afford your payment anymore!)

At this point, millions of homeowners started defaulting on their debts. Those assets that sat at the bottom of the banks’ debt pyramids became nearly worthless, and the entire pyramid came crumbling down on top of them. A single mortgage that may have helped them derive millions in assets was suddenly worthless, forcing them to make serious adjustments in the way they calculated the value of their assets and their business in general.

To make matters worse, the American people got caught up in the drunkenness of the housing boom. The classic example we saw over the previous decade was leveraging the purchase of a new home. With no down payment, a person could purchase a $200,000 new home and take out a mortgage of 125% of the value of the house. Typically this was an “Interest Only Adjustable Rate Mortgage” that was used to purchase a “Spec” house that the buyer was going to flip in just a year or so as the economy was booming. This would allow them to buy the new house and take away $50,000 in cash free and clear to invest elsewhere. Of course, when housing prices started to decline about a year ago, we saw the mass destruction of this “imaginary wealth” across millions of American families. Wealth that, in many cases, had been used to allow consumers to build their own derivative pyramids.

Banks used these “derived assets” to lend money to one another and to you. If the underlying asset wasn’t worth anything, they no longer had any collateral they could use to provide more home loans, car loans, credit card loans, you name it. Debt is the fuel that drives our economy, and suddenly found themselves in a position where they were in over their heads.

The problem is that nobody actually knows how big the derivative problem really is. Even the banks are still figuring it out as they try to reverse-engineer these complex pyramids to figure out how bad their books really are. As they’ve done so, they’ve realized they are effectively insolvent (bankrupt) and we’ve witnessed the collapse of some of the largest banks in the world over the last few months. Hundreds more banks could fail as the credit markets remain tight and banks continue to figure out just how much damage they’ve sustained, and will continue to sustain, as a result of the problems we’re facing.

What’s All This Talk About the “Credit Markets”?

Lately, the LIBOR rate has been setting new records. ((Maybe. See note below.)) LIBOR measures the rate at which banks are willing to lend money to each other. Many banks actually peg their loan rates to LIBOR. (E.g. your bank might have a policy that they lend money to people at 3.0% over LIBOR.) They do this for a very simple reason: if LIBOR is 2%, and you want to borrow $20,000, they can borrow that $20k from another bank for 2%, so if they sell you the money for 5%, they have a guaranteed win (assuming, of course, that you pay back the money) and they didn’t have to put any of their own capital on the table.

Why Are They Out Of Money?

Right now, banks don’t have ANY spare cash to put on the table because the minimum “cash on hand” requirements are already being pushed to their limits due to the collapsing value of their mortgages. Basically, if a bank can show the federal government that they have $20b in assets, they need to keep a certain amount of cash on hand to cover those assets. ((See the Wikipedia article on fractional-reserve banking.)) However, high-risk assets force the banks to have more cash on hand. So if a bank has lots of low-risk assets, they only need a low amount of cash. Lots of high-risk assets means they need a high amount of cash.

Simple, Right?

Now that their assets have all be redefined as high-risk, banks are finding themselves in the position of needing more and more cash—they’re actually getting steamrolled. For every mortgage that’s gone bad, they need that much more cash in their account.

Under normal circumstances, this means the banks would step out and borrow more money from a neighboring bank, but all of the neighbor banks are in the same position, so they certainly don’t have any cash to lend.

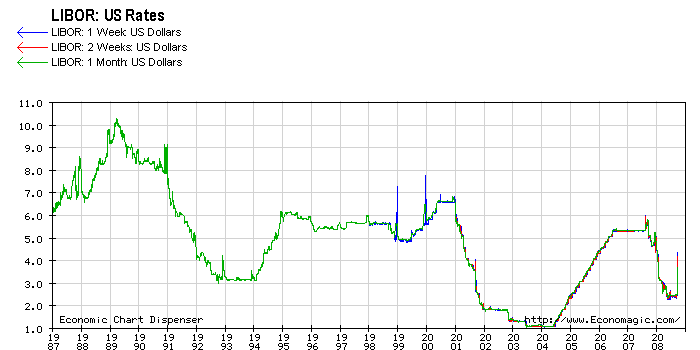

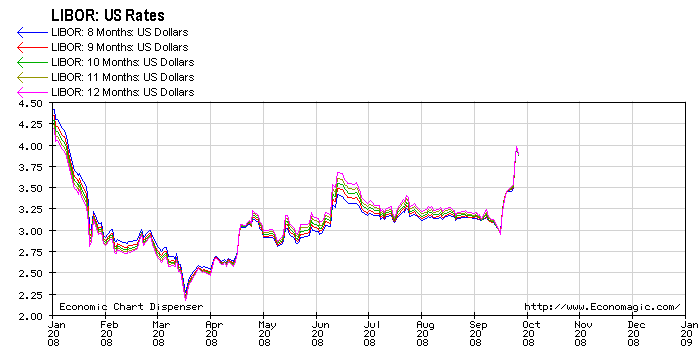

Remember the law of supply and demand? As demand goes up, price goes up with it? Well, demand for cash between banks is going through the roof right now as more and more of their assets are being re-defined and re-valued. If demand is going up, that means price is going up to. The cost to borrow money is no longer in the normally “safe” range for banks (around 1 to 2 percent), but is now approaching 8%… that’s unheard of. ((Actually, 8% is not “unheard of;” It just hasn’t been heard from for a little while. For example, looking at the rate for short-term interbank loans in 2008, you see this:

There’s a clear spike at the very end. But take a step back to see from 1987 to today and you see this:

The abnormal thing seems to be just how low the LIBOR rates have been for much of this decade. Higher interest on interbank lending might be a good indicator, but it’s not the end of the world if it hits 8%. In fact, that might be just the sort of “shock therapy” (to borrow the Russian phrase) that we need if we are to overcome our debt addiction.)) It’s a nuclear bomb on the banking industry. ((That part might be true 😉 ))

You might say, “Well, don’t they just pass that off on to the consumer?” The answer is yes, but they’re reluctant to do that as well because so many of their previously “safe” loans are now defaulting. Even the SBA loans and the loans to large businesses are now in default. So even if they just mark up the 8% to, say, 15% so they can still turn a profit, they don’t want to do it because if that loan goes bad (which they’re finding is more likely than ever) they’re in a far worse position. Not only do they have to pay back the original bank for the money they just lost, but they have another “bad asset” on their books.

It’s Literally a Never-ending Cycle. It’s UGLY.

All of this can be summarized to mean that access to cash (for banks) is now the most expensive it has ever been, that I’m aware of. ((Again, I believe this particular claim is disputable. He did qualify it with “that I’m aware of,” though, so what you see is what you get!)) I would wager that if you walked into your local branch right now and needed a $100,000 SBA loan (normally no problem at all) they would laugh you out of the bank. No loans to businesses and consumers means nobody has any money to dump into the economy. No money to dump into the economy means everything is about to come to a screeching halt. Like within days or weeks. Remember, our gigantic economy is fueled on DEBT… and we just ran out of fuel!

What About the Bailout Plan?

The “bailout bill” is meant to address this problem by getting those bad assets off the bank balance sheets, thus reducing their cash-on-hand requirements and allowing the flow of money to resume. The problem is that $700 billion is a drop in the bucket in terms of the number of bad assets these banks have on their books. It’s not even close to enough. Some estimates say that the size of the derivative market exceeds $450 TRILLION DOLLARS. Under these numbers, $700b is not even a drop in the bucket in terms of the amount of money needed to address this problem.

It is my belief that government regulation got us into this mess. Further regulation and “socialization” of our assets is not going to get us out. As they say in Vegas, “You pays your money and you takes your chances.” The banks paid their money, and now they want the American taxpayer to foot their gambling bill.

Yes, the fallout will be big if this bill doesn’t pass, but it’s my opinion that it will be big even if the bill does pass. ((Note: The bill passed.)) The wealthy elite in America are using this bill as a lifeboat. A way to offload “just enough” bad debt to save their own behinds before the whole thing comes down on top of them. Make no mistake about it, it’s going to come down on top of them one way or the other, the question is whether or not they deserve the lifeboat.

I say the Captain should go down with the ship.

The 5 Stages of an Economic Collapse

Taking a step back from the immediate issues we’re facing, I thought it would be interesting to examine the stages of an economic collapse. This was first presented on the Glenn Beck show, but after a little research of my own, I’ve adapted the items to fit a more “global” model of an economic collapse. We can examine the financial situations in other countries that have experienced such problems over the last 50 to 75 years and identity patterns that emerge when the economies of countries are in serious trouble. Here’s what I’ve come up with:

Stage 1: Housing Downturn: Started August 2007

- Housing downturns turn into a free-fall as the underlying assets that drive the economy rapidly decline in value.

- This triggers a massive number of foreclosures and the wealth of the people vanishes into thin air.

- This sets off a large wave of bank write-downs.

Stage 2: Credit Defaults: Started January 2008

- Consumers begin defaulting on debts in massive numbers.

- Insurance companies who insured those debts lose their perfect credit ratings. The cost of insurance goes up, or insurance companies simply fail.

- Major businesses follow suit and begin defaulting on their obligations.

Stage 3: Bank Failures: Started July/August 2008

- At least one, possibly two major banks buckle under the mounting defaults.

- Hedge funds begin to fail.

- General chaos and uncertainty in the stock market.

Stage 4: Credit Markets Vanish: September/October 2008

- Chaos in the stock market results in new laws to “change the rules” to prevent collapse.

- Most forms of credit (both to consumers and businesses) dry up. Becomes almost impossible to get a loan.

- This results in a vicious cycle of more write-downs, more stock market losses, and more bank failures.

Stage 5: Full-Scale Economic Collapse: … Has not yet begun.

- Full-scale bank panics. Government-declared (temporary) bank closures and market closures to calm the markets.

- Access to cash becomes restricted by the government.

- Government-backed insurers (like the FDIC) go bankrupt.

- Commodity prices soar (gold, silver, oil, gasoline, food). ((Note that recent trading resulted in a nose-dive for the price of crude oil and other commodities, perhaps because of a decline in demand as a reaction to the economic crisis.))

Certainly it stands to reason that we are somewhere in the middle of Stage 4. The government has already set up temporary laws to change the rules in the way stocks can be traded in an effort to help stave off a total meltdown (A good hint that this is for real is that the new laws don’t seem to be having much effect). We haven’t seen credit completely dry up yet, but this is the specific issue President Bush says the bailout bill is designed to address (proving that we’ve reached this stage). Watching the Dow is not a good meter on the health of the economy, but rather watching the lending rates between banks to gauge the availability of cash will show you exactly how healthy the economy is doing. (Hint: It’s very, very bad right now). ((See data here. It’s bad, but not what I would call very, very bad.))

Signs to Watch For As Things Get Worse

It is my opinion that there are a handful of indicators we can watch for that may help us identity (early on) a move towards stage 5. Here are a few:

- News of a failed Treasury auction or news that Treasury rates have spiked. (This would indicate that foreign investors and governments are no longer interested in financing our national debt.)

- A large and sudden spike in inflation. (Indicates the government is panicking and attempting to print their way out of the problem by flooding the markets with money.)

- Any suspension of stock trading or government-mandated bank holidays.

- Any new limits on moving money outside of the U.S.

- Gold exceeding $1500 / ounce. (This is a strong indicator that inflation is taking place or banks are unsafe, even if the formal reports don’t show it.)

- Any closed session of Congress. (This would indicate panic on the part of the federal government.) ((Or it would indicate that Congress was discussing sensitive national security topics. But I don’t think they’re talking much about national security these days….))

- Any new laws restricting the amount of money that can be withdrawn from your bank.

- Multiple (8+) simultaneous US bank failures.

- Run on the banks (large number of people trying to withdraw their funds).

- News that any major western power is no longer accepting US Dollars in payment for key commodities.

- Overt talk of a US default by Asian or European bankers.

Did President Hinckley Prophesy This Disaster?

In 1998, [Gordon B. Hinckley, president of the Church of Jesus Christ of Latter-day Saints] gave a talk in the Priesthood session of General Conference entitled “To The Boys and To the Men”. Here is an excerpt from that talk:

Now, brethren, I should like to talk to the older men, hoping that there will be some lesson for the younger men as well. I wish to speak to you about temporal matters. As a backdrop for what I wish to say, I read to you a few verses from the 41st chapter of Genesis. [He reads Gen:41, specifically references 7 years of plenty and 7 years of famine from the time of Joseph—EVERYONE SHOULD GO READ THESE VERSES!]

Now, brethren, I want to make it very clear that I am not prophesying, that I am not predicting years of famine in the future. But I am suggesting that the time has come to get our houses in order. So many of our people are living on the very edge of their incomes. In fact, some are living on borrowings. We have witnessed in recent weeks wide and fearsome swings in the markets of the world. The economy is a fragile thing. A stumble in the economy in Jakarta or Moscow can immediately affect the entire world. It can eventually reach down to each of us as individuals. There is a portent of stormy weather ahead to which we had better give heed.

A few key take-aways from that talk:

- He specifically references the time of Joseph and the 7 years of plenty followed by 7 years of famine. (Note that if you read the verses, you’ll find that the economy actually collapsed in Egypt during the 7 years of famine.)

- He specifically says he is not prophesying. He is not predicting 7 years of famine.

- He specifically mentions our economy.

- He does prophesy a portent of stormy weather ahead. A “portent” is defined as “a sign or warning that something, esp. something momentous or calamitous, is likely to happen.”

A few years later in the October 2001 general conference, immediately after 9/11, President Hinckley’s talk again referenced the time of Joseph and the 7 years of plenty and the 7 years of famine. He said:

I do not wish to sound negative, but I wish to remind you of the warnings of scripture and the teachings of the prophets which we have had constantly before us. I cannot forget the great lesson of Pharaoh’s dream of the fat and lean kine and of the full and withered stalks of corn. I cannot dismiss from my mind the grim warnings of the Lord as set forth in the 24th chapter of Matthew.

This time, however, he did not say he was “not prophesying” in relation to mentioning this dream. It is PURELY MY OPINION that this is highly significant.

Please note that this talk was given exactly 7 years ago (October 2001). I will let you decide if this has meaning for you and your family. As for me and mine, well….

What To Do About It

This is the hardest part. The answer is, at this point, the train-wreck is already taking place and there’s probably not much you can do. If I could offer a few pieces of advice:

1. Are you doing what the prophet has asked in terms of spiritual preparedness?

- Are you holding regular family home evening?

- Scripture study?

- Prayers?

- Attending the temple?

- Attending all your [church] meetings?

If you are not doing these things, it is my opinion that nothing else will matter.

2. Are you doing what the prophet has asked in terms of temporal preparedness?

- Are you out of debt?

- Do you have a year’s supply of food for your family?

- Do you have a little money set aside in case of a rainy day?

When it comes questions like “Should I take my money out of the bank?”, “Should I cash out my 401k?”, or “Should I sell all my stocks?”, I cannot answer those questions for you. I would encourage you strongly to make those things a matter of personal prayer and act on any promptings you receive.

I hope you take this in the spirit it was intended. As a warning to lift up your head and watch around you as the events of our time unfold. These may not be the last days, but it seems clear to me we are headed for some rough times ahead. President Hinckley has always counseled us to be optimistic about the future, but always to be prepared.

NOTE:

Permission is granted, and you are ENCOURAGED to SHARE THIS.

Leave a Reply